by Terence Kawaja

I am far from the most natural commentator on advertising agency holding companies. My M&A advisory business, LUMA Partners, focuses on ad technology and data businesses more than services companies. But in some ways perhaps my distance qualifies me as an objective observer.

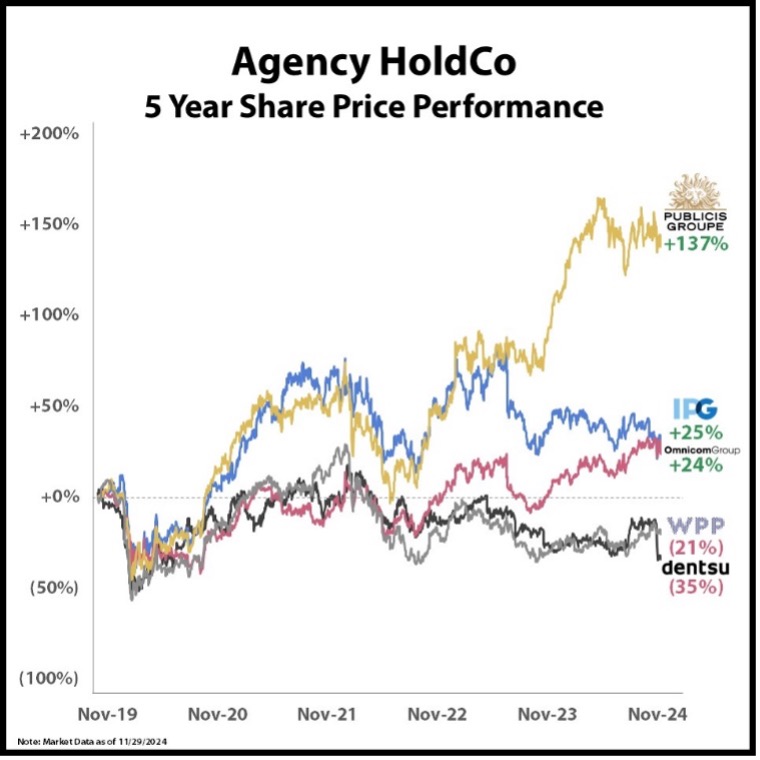

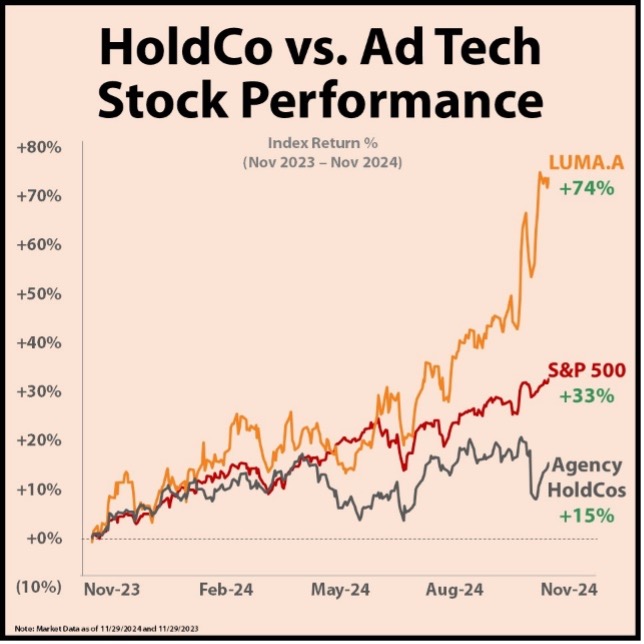

It’s no secret that Publicis Groupe has outperformed both on an absolute basis as well as in comparison to its ad holding company (“HoldCo”) brethren. In the last five years, Publicis’ market cap has more than doubled (+160%) from $10.5 billion to $28 billion as the firm has racked up big client wins, largely at the expense of WPP.

In the same time period, Omnicom and IPG saw gains of 24% and 25% respectively, while Dentsu and WPP’s market caps dropped with WPP’s shares down 21%, as its market cap dropped almost $5 billion from just over $16 billion to under $12 billion.

This outperformance comes down to three primary factors: 1) technology strategy, 2) leadership and 3) dealmaking.

1) Bold Technology Strategy

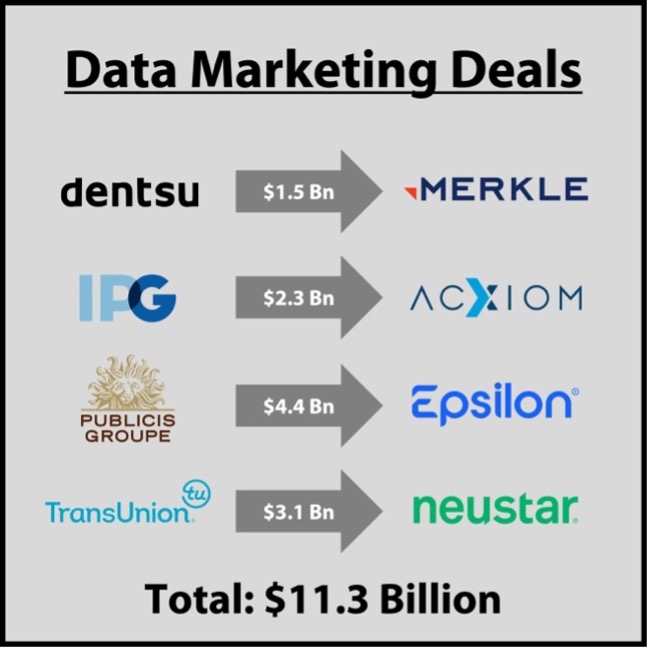

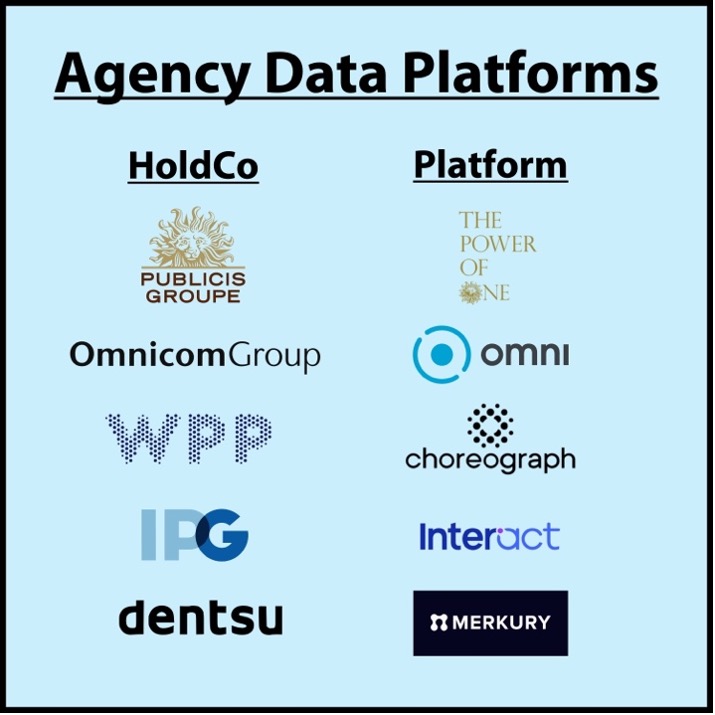

Publicis’ technology strategy has been a major factor in its success. Publicis bought Epsilon for $4.4 billion in 2019, relying on it to unify all client data across first-, second- and third-party sources. The Power of One centralized platform federates data to all Publicis agencies.

This strategy creates a great narrative in pitches for global marketing contracts, which helps explain Publicis’ extraordinary win rate.

For comparison, other agency HoldCos have made similar moves (IPG bought Acxiom and Dentsu bought Merkle), but have not executed their go to market strategies as well. WPP, IPG and Dentsu did a lot of internal reorganization (which they hilariously referenced as “mergers”) that seemed only to shuffle pieces around a board without much tangible benefit.

Not all agencies pursued data strategies via M&A. Omnicom organically launched Omni, which seems to be driving some success. WPP organically launched Choreograph and hired Brendan Moorcroft to run it, but he didn’t have the tech platform necessary to make the strategy work (I described him as having a badge but no gun). Ironically, Moorcroft is now at Publicis as its Chief Engineering Solutions Officer.

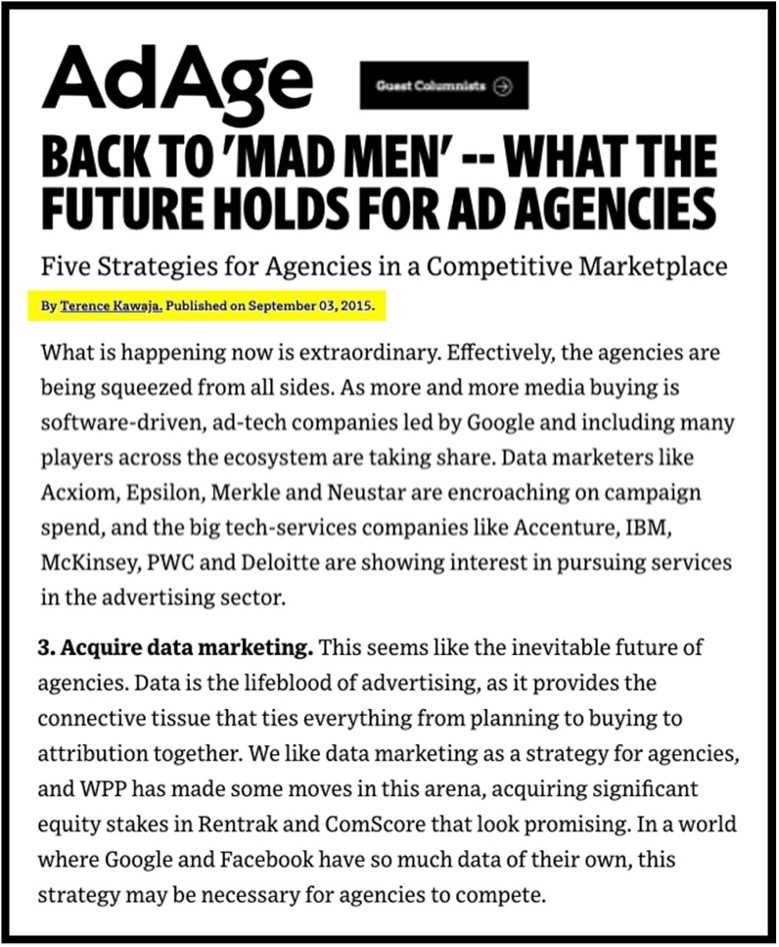

The real irony here is that WPP was early to adopt a centralized data strategy with the go-to-market approach of its Wunderman agency, which acquired KBM in the late 90s. But it didn’t prioritize that effort, which seems like a missed opportunity. This might sound like 20:20 hindsight, but I advocated for agencies to adopt a centralized data strategy and specifically called out Acxiom, Epsilon, Merkle and Neustar as data marketing targets back in 2015 in this AdAge guest column in which I speculated on the future of agency holding companies:

Publicis’ long-standing lean-in approach to technology has positioned it to be an early adopter of AI, too. The AI push started with its work on the Marcel platform in 2018 (before AI was cool), all the way to today with a significant $314 million investment in CoreAI. And since data is the necessary raw material for AI, Publicis’ data strategy and its AI strategy arguably are intertwined.

2) Progressive Leadership

Human capital in the agency services sector is a critical element of success where Publicis distinguishes itself.

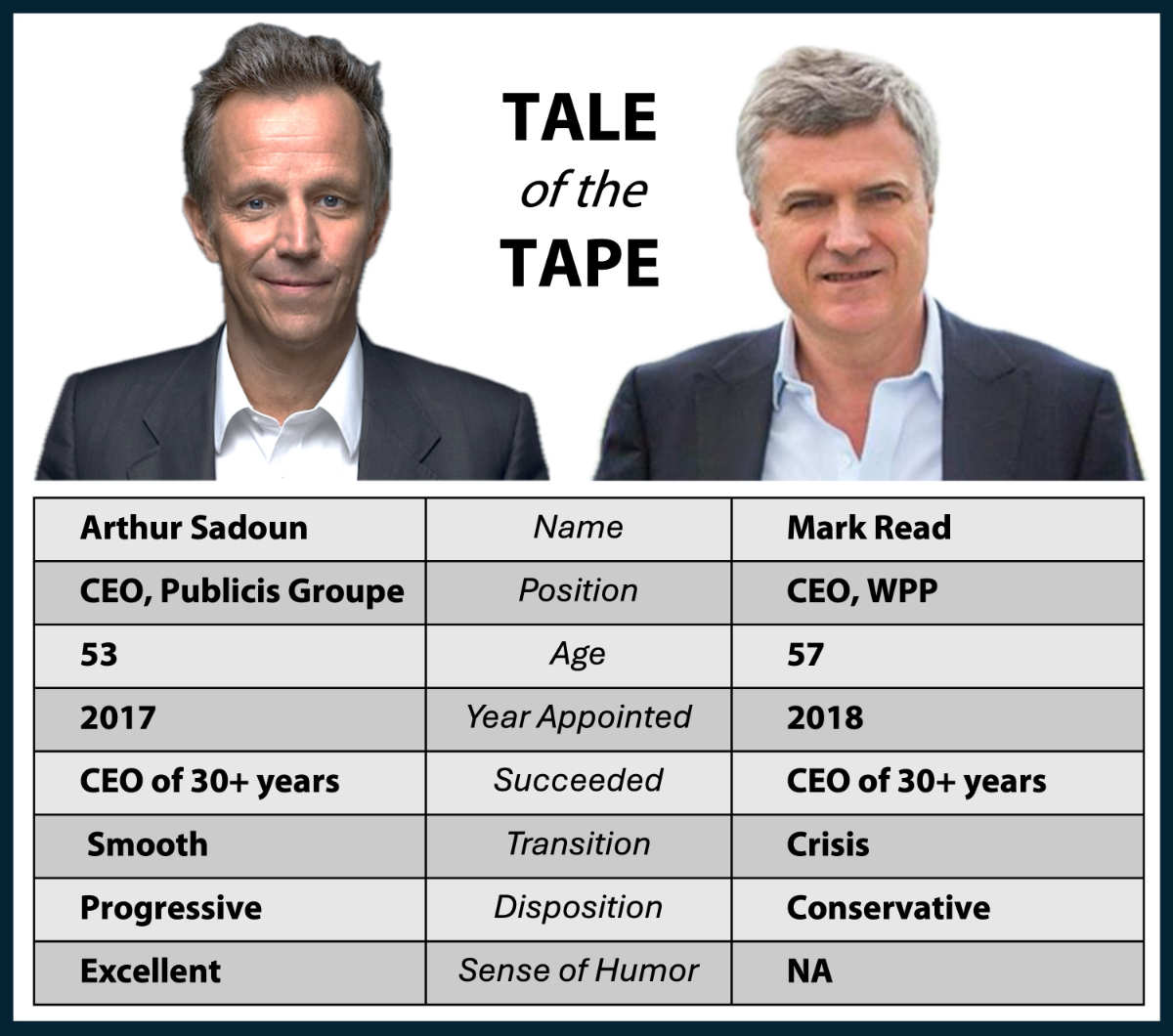

Publicis CEO Arthur Sadoun and WPP CEO Mark Read are extremely comparable on paper: similar age and tenure, and both took over for a long-time leader – albeit Sadoun had a smoother transition as 30-year Publicis CEO Maurice Levy’s handpicked replacement, while Read was a reactive choice by the WPP board after the sudden departure of Sir Martin Sorrell.

But there’s a key differentiator between the two: Sadoun has a progressive approach to the evolution of the agency business model whereas Read is more conservative. At a time when so much change — privacy, cookies and more — is sweeping across the advertising sector, the market rewards the former over the latter. I’d also argue that having a good sense of humor is a strong skill set.

An interesting fact to note: Mark Read ran Wunderman following his role as Chief Digital Officer at WPP and prior to his COO and then CEO role with the parent company. If there’s a HoldCo leader that should understand the need for a comprehensive data strategy, it would be Mark.

Publicis’ hiring of Scott Hagedorn from Omnicom in 2022 to drive its technology strategy is another differentiating factor in its favor. And all hope is not lost for WPP, which also has strong potential future leaders. WPP’s re-hiring of Brian Lesser as CEO of GroupM is a very positive move that will likely pay dividends to WPP shareholders. He is deeply tech-knowledgeable and prone to lean into innovation. I suspect he will work well with the like-minded CTO, Stefan Pretorius.

3) Smart Dealmaking

Naturally, bankers appreciate an acquisitive company but I think I can credibly and objectively argue that a well-executed acquisition strategy at a time of industry change is also a positive differentiator: it demonstrates a forward-thinking outlook and business agility.

All HoldCos make agency acquisitions. But few make acquisitions of different business models. Here, Publicis has led its peer group with acquisitions of Epsilon (data) in 2019, CitrusAd (commerce) in 2021, Profitero (commerce) in 2022 and Influential (creator marketing) in 2024.

These strategic acquisitions were key accelerants to Publicis’ long-term plan to switch its business model from agency to platform. The price tag on the Epsilon deal, which represented more than 35% of Publicis’ market cap at the time, was a “bet the ranch” strategy that has paid off in today’s value.

However, it’s worth noting that Omnicom made its largest ever acquisition of Flywheel Digital (commerce) in 2023 which we believe sets it up well for the massive commerce media trend.

A true market leader

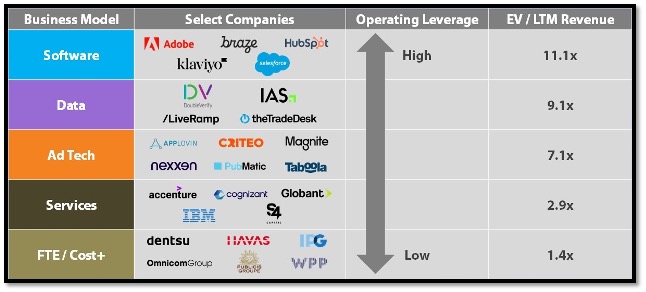

Thanks to its technology-centric platform approach, its adaptive leaders and its acquisition strategy, Publicis enjoys higher operating leverage, which the markets reward with a higher valuation multiple. This explains why Publicis trades at a 1.9x multiple of net revenue, compared to 1.1x for WPP and 1.2x for the agency HoldCo average excluding Publicis (or 1.4x including Publicis).

Source: FactSet (market data as of 11/29/2024).

You could conclude that Publicis has out-WPP’d WPP in the sense that they leaned into tech (the way WPP used to) and they leaned into dealmaking (the way WPP used to). Heck, they even leaned into proprietary media trading (the way WPP pioneered)!

If Publicis continues this transformation to a platform, a 1.8x revenue multiple has a lot of upside potential. Publicis’ $16 billion market cap gain in five years is impressive but pales in comparison to the platform opportunity.

If Publicis continues this transformation to a platform, a 1.9x revenue multiple has a lot of upside potential. Publicis’ $17 billion market cap gain in five years is impressive but pales in comparison to the platform opportunity.

To put this in context, the LUMA.A index that tracks the public Ad Tech cohort, led by AppLovin, is up 74% in the last year, gaining $114 billion – more than the total market capitalization of the five HoldCos combined!

Publicis Groupe’s success reflects its ability to adapt and innovate in a rapidly changing industry. By embracing a forward-thinking technology strategy, maintaining progressive leadership, and executing transformative acquisitions, the company has set itself apart from its peers.

With a platform-centric approach driving client wins and operational efficiency, Publicis has positioned itself for sustained growth and unlocked significant market potential, signaling that its gains may only be the start of something much bigger.