Insights

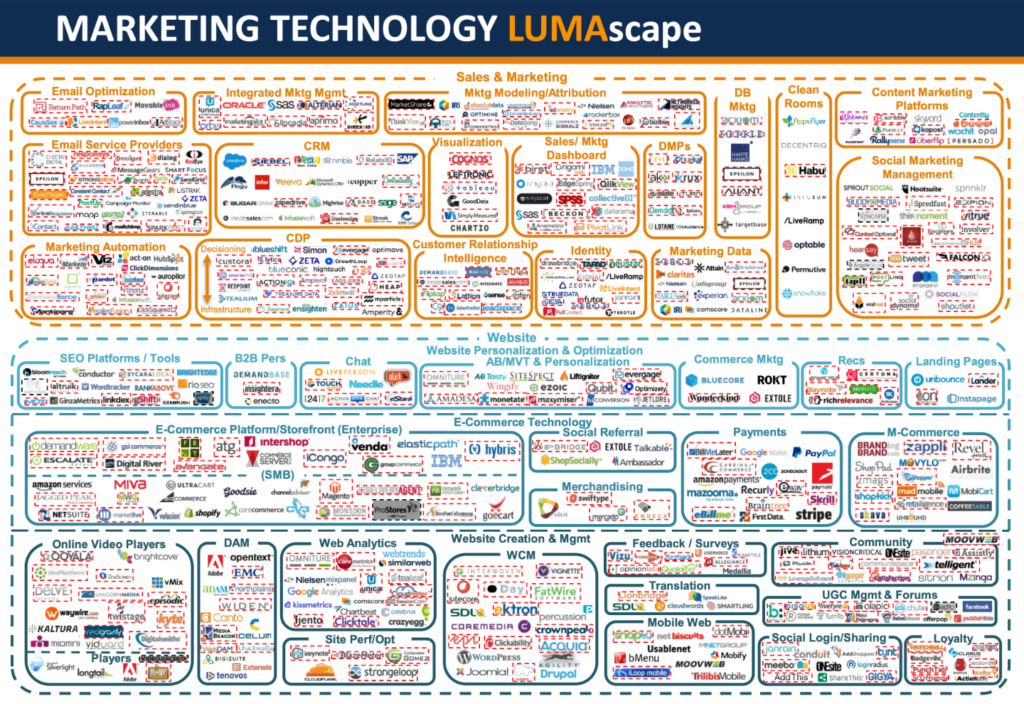

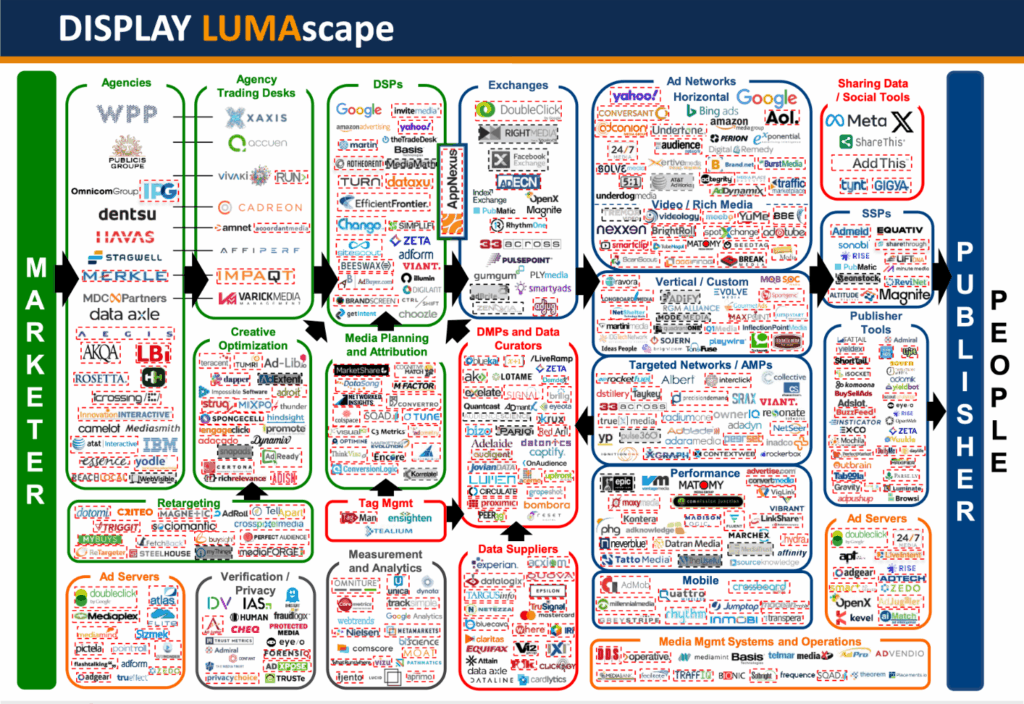

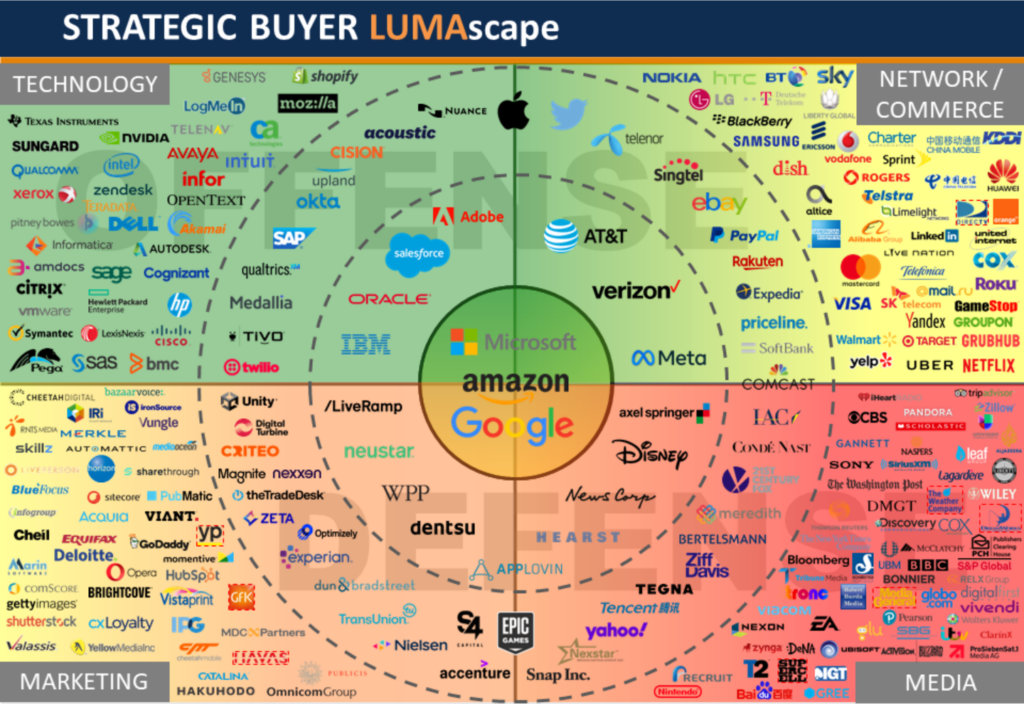

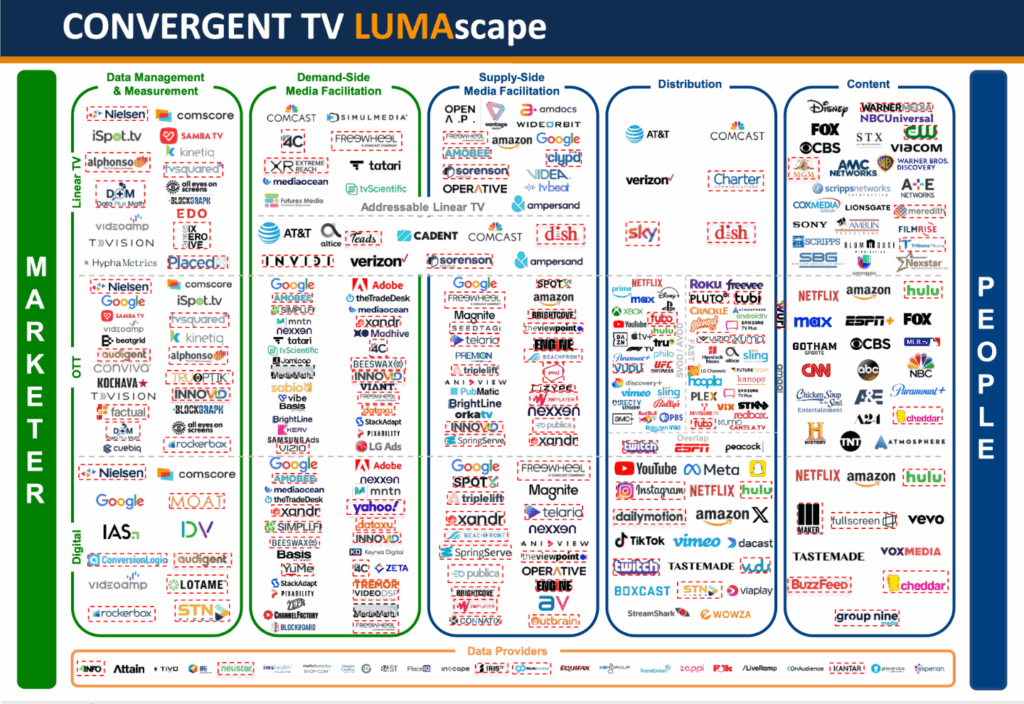

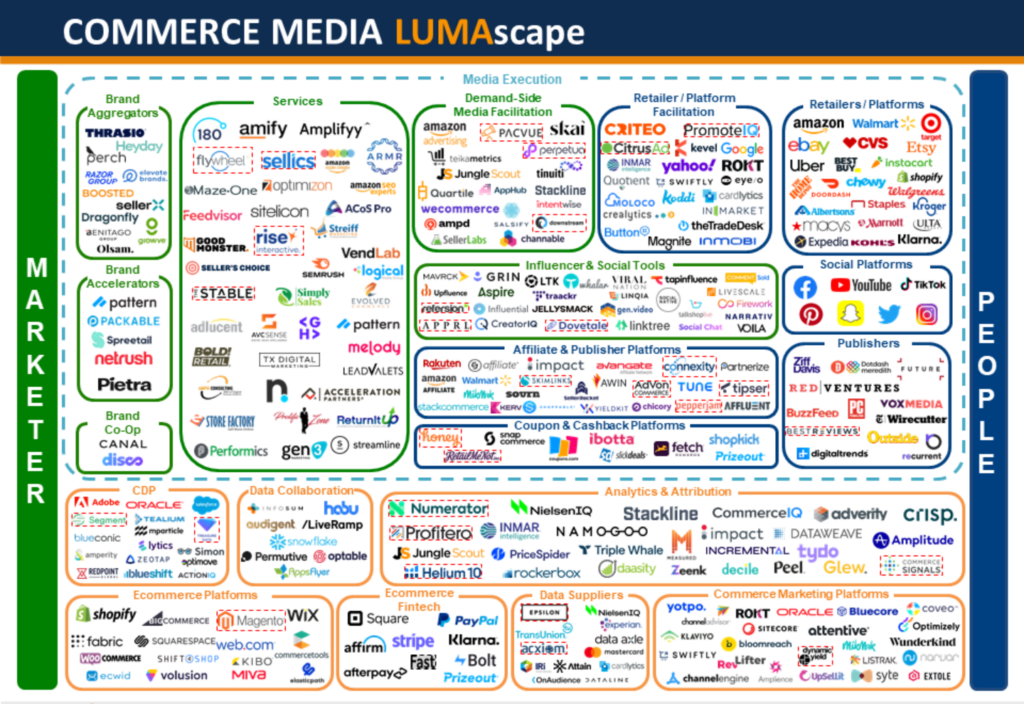

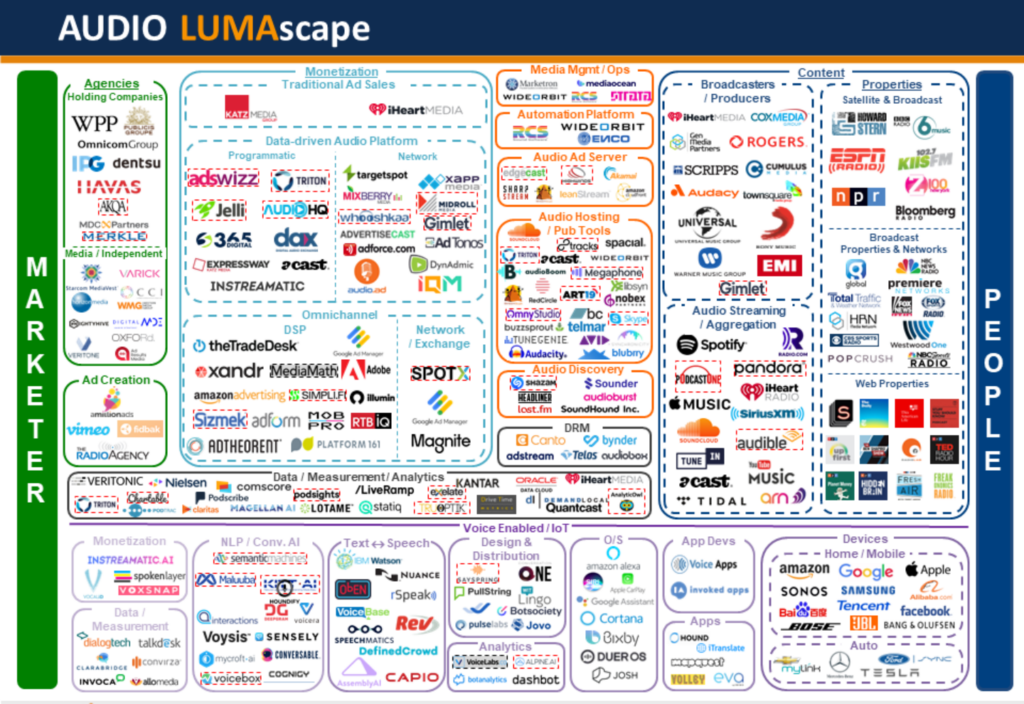

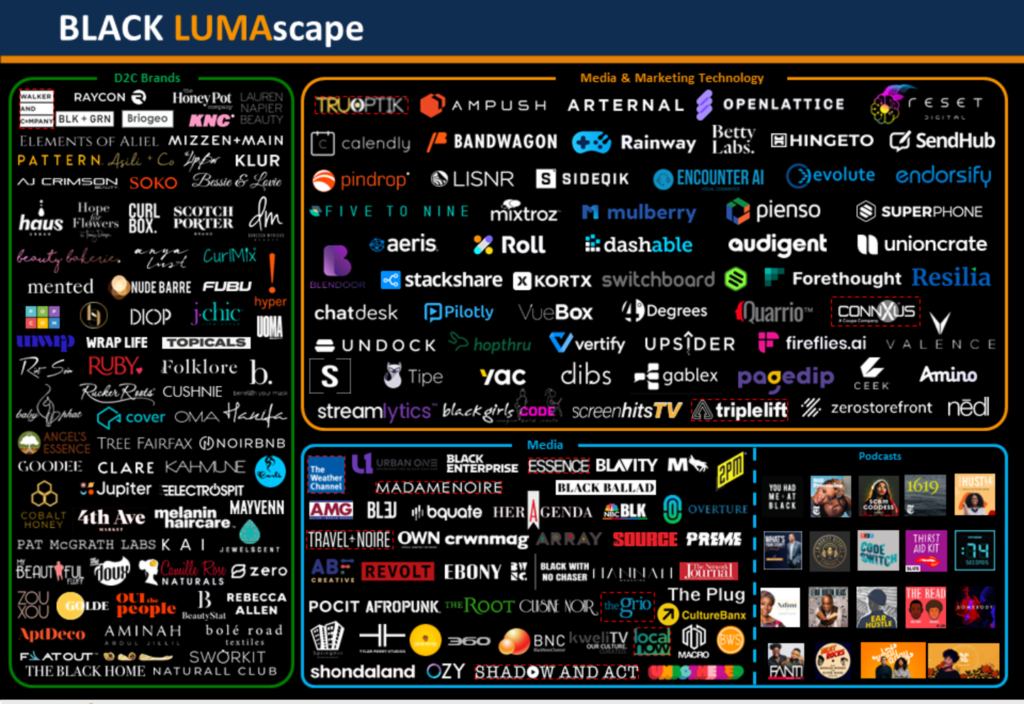

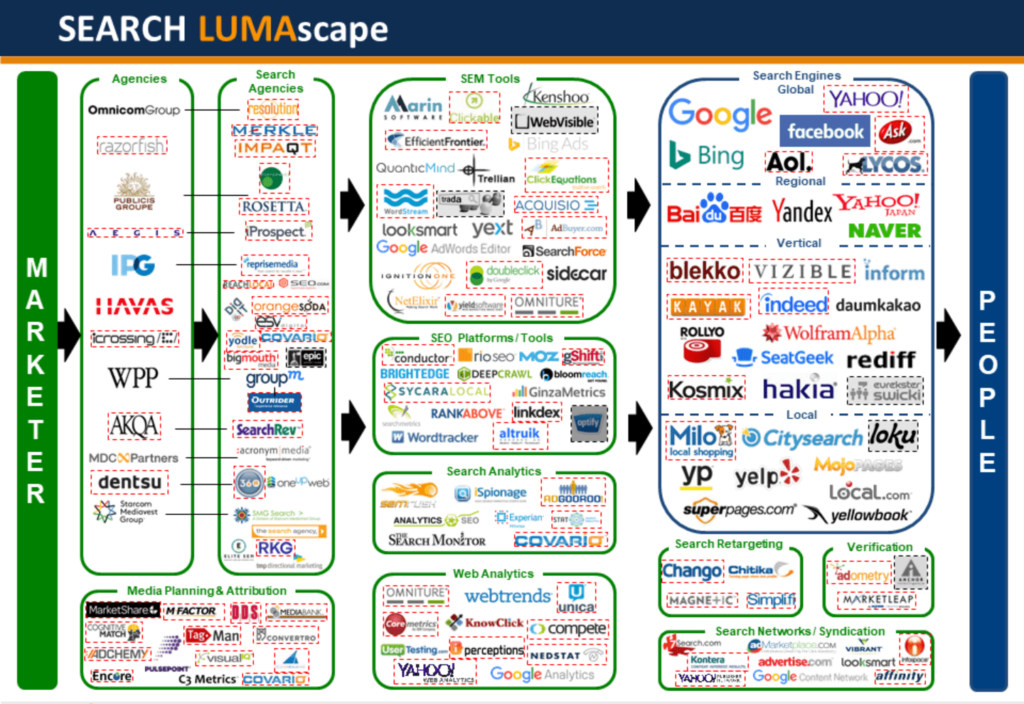

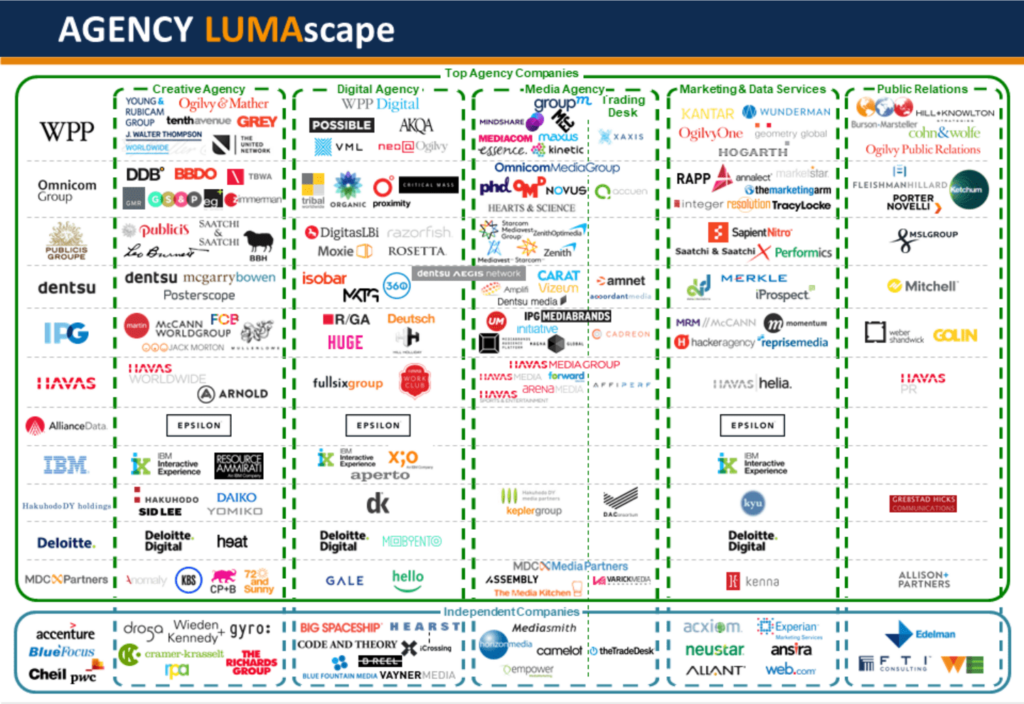

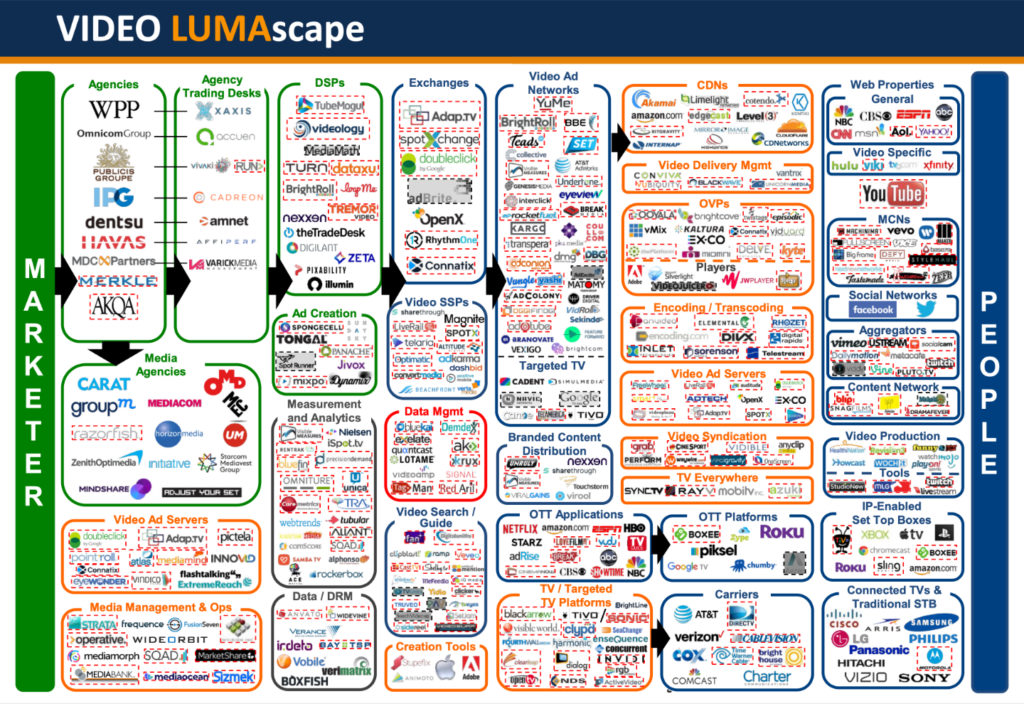

LUMAscapes

The LUMAscapes are internationally recognized and referenced resources categorizing how companies within the digital ecosystem fit together. There are 23 and counting.

Presentations

Provocative storytelling that distills complex issues into relatable content at its best. Our presentations consist of targeted insights based on keen observations and POVs focused on the good, the bad, and the ugly.

Market Reports

Our Market Reports cover the M&A performances of the public and private markets in Ad Tech, MarTech, and Digital Content. We observe the notable trends which drive investment and deal activity. Published at the end of each quarter.

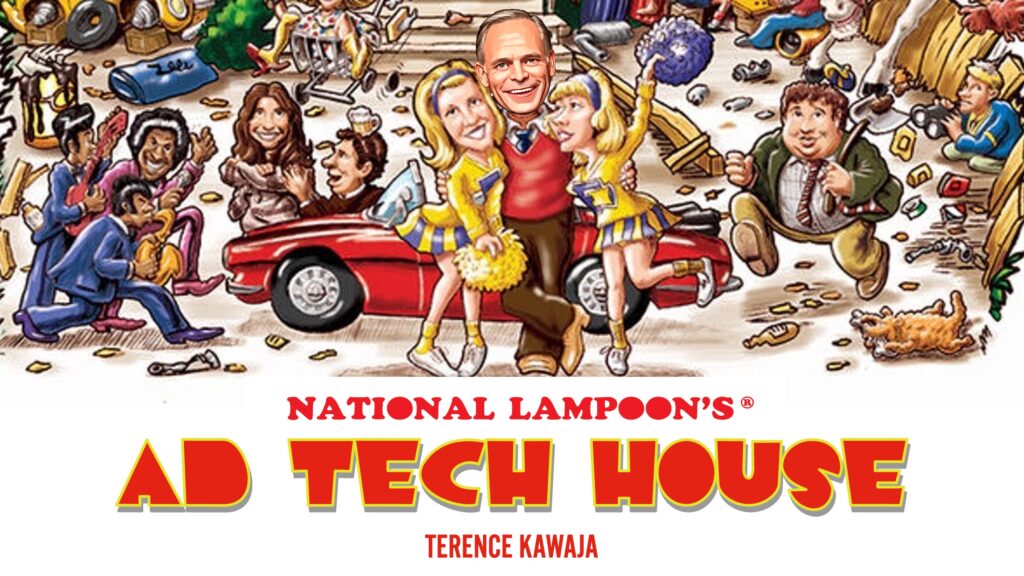

Funny Business

You might recognize a face or two (or many) in our infamous parody videos which highlight the latest hot topics in digital. It’s all in good fun. At least we think so.