Conor McKenna, Director at LUMA Partners, explains the difference between Ad Tech and Martech with MarTech Record’s On The Record.

Today, ad tech and martech are trading at similar evaluations, but that wasn’t always the case.

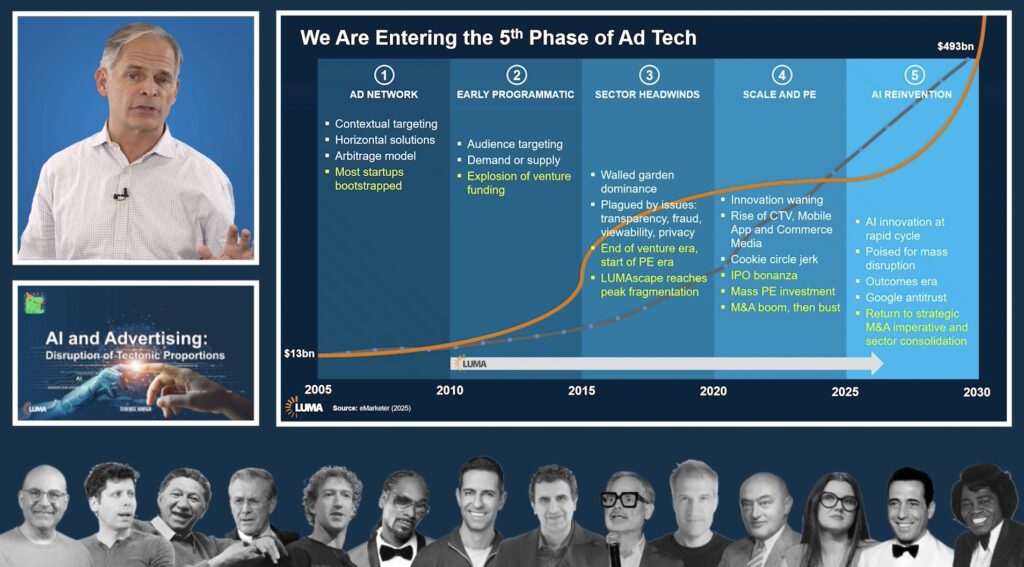

About a decade ago, there was a large gap between evaluations of advertising technology and marketing technology – marketing technology businesses were trading 5 to 10 times net revenue, whereas ad tech was trading close to just one times valuation, said Conor McKenna. McKenna is a director at Luma Partners, a strategic advisory firm with a singular focus on digital media and marketing.

“So we were trying to unpack that to find out what is the difference?” he said.

The answer largely comes down to what’s being valued more – media or software, McKenna said.

As McKenna explains it, software businesses are platforms that are in SAAS and are built to scale with growth. With that growth, they tend to be selling an annual contract with a flat price with the expectation that it’s recurring. Media businesses, however, are much more “a function of eyeballs at that time and sales at that time,” McKenna said. “You don’t have that true occurring nature to them – they are much more ephemeral…They have a lot less operating leverage.” That makes for a difference in unit economics. Media businesses tend to trade more on profits and therefore often lower revenue multiples.

The issue to explore, though, isn’t the difference between how media businesses and software businesses trade.

What Luma Partners has been trying to explain, even going back to a report from 2014, was this notion of new advertising technology and whether it’s valued more like media or more like software. That report, called “Color by Numbers: A Valuation Framework for the Ad Tech Sector,” asserted that media networks or advertising networks (really the early days of ad tech) were effectively media channels.

“Therefore you had good margins on that, but very low overall gross margins. They looked like a media business and they frankly were,” McKenna said.

Then ad tech companies began to enter the public market, as do a few programmatic businesses.

“Our notion then was programmatics should be traded a lot more like SAAS,” McKenna said. “It turns out, going back 10 years, the public market didn’t understand this.”

That’s why the gap existed between the trading of ad tech and marketing tech, he said – marketing tech was trading like SAAS and ad tech traded like media. That held true until about 2017 or 2018, when media networks started to get acquired and what was left as the public cohort were more true SAAS platforms like The Trade Desk, Rubicon Project and Telaria.

“What we quickly saw was that ad tech started to meet martech pretty quickly,” he said.

Then the pandemic hit, and trading changed drastically.

“We’ve now traded down a ton over the last few years… what’s held is that notion of more parity in valuations,” McKenna said. “That’s something we’re very interested in and how the sector seems to be understanding ad tech as more platforms and SAAS-like even though its not true locked-in SAAS contracts.”

The value of recurring revenue versus contractually-occurring revenue is more newly understood now, he said. There was a long period where media businesses and ad tech businesses were trying to claim to be SAAS or contort their business models to be SAAS-like, but that doesn’t always work, McKenna said.

Snowflake, for example, specifies that it is not SAAS even on its investor decks. By being a usage-based platform, they are better able to accelerate growth throughout the year.

So are affiliate platforms and networks considered ad tech or martech?

“I’ll give you the frustrating answer,” McKenna said. “I think it’s both.” Deciphering the answer depends on how that business prioritizes media or software, he said.

Click to listen to the full conversation: MarTech Record